Bend Oregon . . . Distressed Real Estate

Mortgage Distress in Upper Echelon

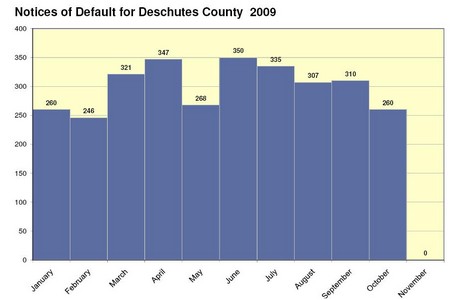

An interesting article in the San Francisico Chronicle highlights a trend that has now become prevalent in our Bend and Central Oregon real estate markets. The article speaks about the rise in mortgage distress now found in affluent areas . . . areas like Danville, Los Altos, and Piedmont (read Broken Top, Awbrey Butte, and Pronghorn) where housing prices top $1,000,000. According to MDA DataQuick, twice as many households received default notices from January to October as in the same period of 2008.

The same is true for more mid-scale areas–Awbrey Glen, The Parks, Northwest Crossing– are communities that quickly come to mind.

“The question is, could this be the beginning of something that gets a whole lot worse?” said Andrew LePage of DataQuick. “The distress in the high end now is important to watch; it helps explain why we have more sales (of high end homes). More distress means more motivated and more realistic sellers. We’re just starting to find out whether the riskier loans that were not subprime will come back to haunt us.”

In Bend, the combination of rising unemployment at all levels of income and the “recasting”of exotic loans used in the purchase of expensive homes are probably the culprits. In all of Central Oregon, as in the Bay Area, values have slumped for homes at all the price points . . . leaving many high end homeowners upside down.

Feel Our Pain

During the red hot Bend Oregon real estate market of the early 2000’s, many people who bought million dollar plus homes actually bought more than they needed. ” Part of the purchase was for investment purposes.” The majority of folks felt real estate values in Central Oregon would go up forever. Now that reality has begun to set in, the dynamic is changing . . . why would an owner of a $600,000 home with an $800,000 mortgage continue to fight to make the payment?

Problems at the high end do play out in slow motion. In part because most affluent buyers have more resources and more financial know how. Some homes (generally “move up” buyers) were purchased with substantial down payments–sometimes leaving an “equity cushion” even as values decrease. On the flip side, mortgage holders have fewer remedies.

Bend’s increasing incidence of high end mortgage problems is a reflection of the national trend.

Learn more about distressed properties in Bend.