January 2025 . . . “You Start The Year Off Fine”

January 2025

Despite the words of Neal Sedaka (“January, you start the year off fine!”) in his all-time classic hit, “Calendar Girl,”

our real estate market in Bend didn’t begin the year like that; in fact, it kinda bumped along. Still, not really too much cause for concern (yet) as January has historically been the slowest month of the year for real estate sales. Looking back, in January of 2024 we saw just 91 sales; in 2023, 84. So perhaps there’s cause for a bit of optimism moving forward.

This past month we saw 115 homes purchased.

- 26 over one million dollars (five over $2M) . . . that’s 23%

- 31 cash transactions (27%) . . . including 4 of the 6 most expensive

- Median price bumped to $734,900 (up from the previous month of $700,000) . . . all-time high was $800,000

- Overall available inventory = 2.5 months (no change)

- Days on market increased to 59 (highest in 3 years)

- Interestingly, Redmond’s median price hit an all-time high of $562,000

- Interest rates hovered around 7%

Luxury Bend . . . $2,750,000

Looks like we’re back on the Tetherow train, as the most expensive home sold in January was this 4/4, 3712 square foot house backing to the National Forest.

The stunning contemporary design featured an open plan with two main level primary suites, an airy discerning (?) kitchen,

a spacious office, spa-like bathrooms, and a three car garage.

The home went pending in 152 days (not unusual for this price point), and closed at $135,000 below list (at a lofty $741 per square foot).

Bend’s Median . . . $734,900

Bend’s median priced home in January would have resembled this new construction in the Sky Vista subdivision, near Mountain View High School.

The 5 bedroom, 3 bath, 3006 square foot “modern farmhouse” featured a main level bedroom (mother-in-law?), bathroom, an office, and an open concept living space.

The state of the art kitchen offered a hefty island and a nice layout.

The primary as well as three additional bedrooms and a laundry were up . . . all, I might add, conferring an air of “elegance and comfort.” A three car garage completed the picture. “A perfect abode (abode?) for anyone looking for their ultimate dream home.”

It closed at $249 per foot . . . pretty good bang for the buck!

Comparison of the median prices on each side of town:

East side $670,000

West side $1,050,000

Bargain Bend . . . $415,000

One of just five homes to sell for less than $500,000, the best bargain in Bend in January was this steal on Robin Hood Lane (yes, lame pun intended).

A charming 3 bed, 2 bath, 1672 square foot single level in Nottingham Forest, I mean Square; the home offered some great bones and a large lot. Built in 1978, it featured a pretty new (2022) roof, vaulted ceiling, and an open plan. The lot offered plenty of green open space, some room to roam, and a garage with a cool tree in front.

The home also needed some “cosmetic renovation” (surely, a euphemism for something), and was priced accordingly.

It did close at $20,000 below list at $248 per foot. A pretty nice deal!

Looking Ahead

Always a tough task! This last month has been an “interesting ” (I could think of a lot of other more descriptive words!) one on a variety of levels. Thus things are a bit more cloudy than previously. Nevertheless, we’ll give it a shot at a little prognostication.

As mentioned above, January is traditionally the slowest month of the year. But as the weather improves and we start to move toward spring, we’ll undoubtedly see more available inventory hitting the market.

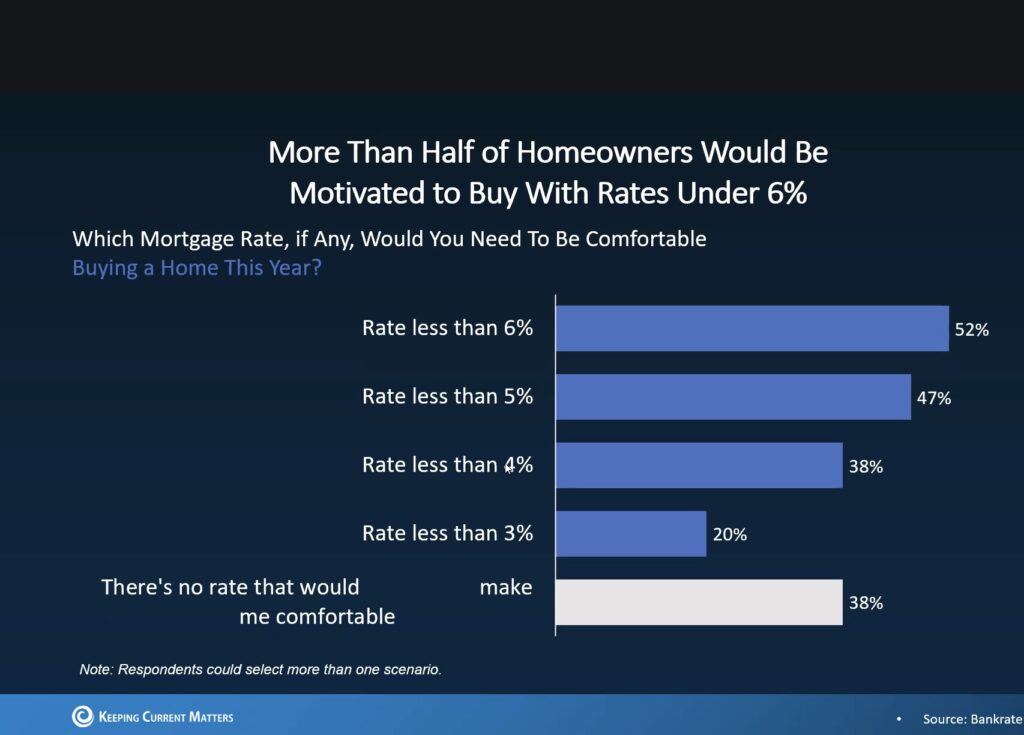

We’ll see improvements in interest rates as well, though not quickly enough. I’d envision a rate of around 6% by the end of summer. However, there is some real money out there . . . evidenced by the number of cash transactions in the higher price points.

Unfortunately, affordability will continue to be a thorny issue in 2025. Though we’re seeing anticipated price reductions in a few specific markets (Tucson, Phoenix, Provo, West Palm Beach all come to mind), in most other areas (Bend included), slightly stronger demand as well as politically-based uncertainty (tariffs, labor shortages, inflation, immigration issues) will continue to elevate home prices and leave some potential buyers on the sidelines.